Housing Market Sudden Downturn

Post last updated: November 2, 2022

In the summer, the media started reporting about housing market confusion and fears of a collapse. The interest to buy houses dropped by large mainly because of rising mortgage rates. For example the 30-year fixed mortgage, one of the most popular home financing products in the US, increased from 3% to 6% from the beginning of this year.

As recession concerns weigh on consumer outlooks, our survey shows uncertainty has made its way into the minds of many buyers.

Danielle Hale, chief economist at Realtor.com

Higher Prices and Low Supply

This September, prices were 43% higher than at the start of the covid pandemic. Supply of homes grew 27% from the same period last year, still not enough to cover the years-long shortage of homes. House construction slowed down first because of material price increase.

Building materials prices increased 20.4% year over year and have risen 33% since the start of the pandemic.

National Association of Home Builders

Tighter monetary policy from the Federal Reserve and persistently elevated construction costs have brought on a housing recession.

CNBC

Most recently, home builders are slowing down the production of new houses as a response to fewer potential buyers touring model houses. Data shows buyers didn't disappear entirely, some are using the thinning competition and some are exploring smaller markets. Home prices are cooling off. The decline in prices of 0.77% from June to July is the largest single-month decline since January 2011. It is the second-worst performance in July since 1991 Great Depression.

Currently, prices of real estate even in the most lucrative areas are beginning to fall. Are there any parallels to 2008? America's pandemic price boom is over. According to the Case-Shiller index, prices fell by 1.3 % in August for a second consecutive month. This was the largest drop since March 2009. New home sales decreased by 10.9 % in September. One of the driving factors might be the high prices of mortgage when purchasing a new home. At the time of writing, already 7% rate on a 30 years mortgage is the highest it has been in over 20 years.

A monthly mortgage on a median-priced home with a 20 down payment went from thirteen hundred dollars a year ago to over twenty-three hundred dollars now. That's an eighty per cent increase in payments.

Guy, CoinBureau

Demand for mortgages is half of what it used to be last year and at it is lowest from 1997.

The recent interest rate hiking policy of Jerome and Co. resulted in what we see happening with the mortgage rates. That being said, they don't seem to be bothered by the influence their actions have had on the housing market.

In September, Jerome Powell stated the housing market has to go through a correction. He also mentioned the slowdown "in housing prices that we're seeing should help bring prices more closely in line with rents and other housing market fundamentals and that's a good thing." The thing is, FED is not slowing down anytime soon. The last meeting saw another 75 bps increase. The expected hike is around 4.5% - 4.7% in Q1 2023. This was the case last time in 2007.

Increased mortgage rates are not the only problem. First time home buyers might experience problems collecting the first downpayment as the surging inflation decreases purchasing power making saving much more difficult. On the supply side, the number of new family houses grew from 25% in Q3 last year to 29% in the same period. Meanwhile, the sales of new houses plummeted to a six-year low.

... plunging mortgage applications suggest the collapse will only get worse. Research firm Pantheon Macroeconomists projects monthly new home sales could fall to a ten-year low of 350,000 as soon as this month.

Forbes

The investment bank Morgan Stanley believes the house prices might fall down 7% until the next year. They also talked about a bull market scenario when housing prices would decrease by 5% and a bear market one where we would see a decline of 10%. Goldman Sachs updated their last month's estimate of a 1.8% rise in prices to a 5 - 10% fall. Should we get to hit a recession, the prices might fall 20 to 25% causing lots of pain. We are not exactly at the 2008 armageddon levels but the situation is worrying.

Is Canadian Housing Market Approaching the 2008 US Scenario?

Canada's housing market might be one of the biggest housing bubbles in the world. Cities like Vancouver and Toronto have seen prices tripled over the past 25 years. Several factors are driving the prices up here; high immigration levels, increased investment demand and falling mortgage rates. Housing affordability became a much larger issue in Canada than in the US.

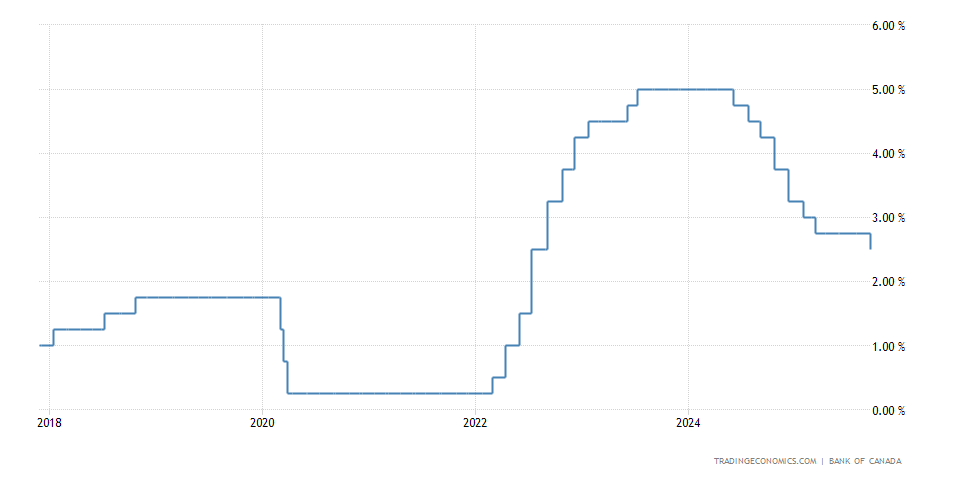

In 2019 the bank of Canada dropped its benchmark interest rate to 0.25%. As a result, property prices climbed up 17%.

Source: tradingeconomics.com

Bad debts are another problematic factor. One-third of all mortgages consist of variable mortgages where the rate is fixed only at the beginning and starts to fluctuate at a later point. Those who took out those seemingly good deal mortgages are now experiencing fluctuations based on the Canadian central bank raising the interest following the US FED decisions.

Investors have to rely on rising rental rates to make up for the rising mortgage and servicing rates.

UK Market Confusion

In the UK, house prices fell by 0.1% in August as well as in September. Truss and her Chancellor released a way too optimistic budget without considering the income. The market became extremely confused.

... one of the side effects of that budget was that UK government bond yields went soaring. These are the interest rates that mortgage providers use to price their fixed-rate offerings. Therefore, in the wake of that chaotic budget, these mortgage products were left in turmoil.

Guy, CoinBureau

Despite the budget being pulled down and a new PM installed, the mortgage rates are slow to adjust back and lenders are not passing on the low-interest rates to those taking out the mortgages. Homeowners and potential buyers are left with uncertainty, especially those who took out fixed mortgages. Fixed-rate mortgages in the UK are "fixed" only for the first 2 to 5 years, and then they increase.

The bank of England raised the interest rates by 75 bps, the biggest interest rates increase in 33 years. The impact on an average homeowner might be too much to bear. As a result, they might be forced to sell their home. In the end effect, UK house prices might fall between 10 - 15% according to analysts.

In the UK, the cost of living already increased through a 10% inflation might increase further especially for those needing to refinance their mortgage. Let's see if the new PM can do something.

Global Markets

The global housing market is expecting some large turbulences. The homeowners starting in the US and especially in Canada are expecting massive corrections. In Canada, this could mean a situation similar to the 2008 housing bubble burst in the US. Canadian GDP would take a large hit if this was the case. Yet, there is an opportunity hidden for prospective homeowners.